Coffee in Ethiopia

90% of Ethiopian coffee production comes from small farmers of less than 2 ha (garden coffee), while forest coffee (State-owned plantations) and private coffee estate account for the rest.

Ethiopia's annual production is around 449,000 metric tons, according to the Ethiopian Coffee and Tea Development and Marketing Authority. About 50% of total production is consumed locally.

TRADING SYSTEM

There are currently three ways of selling coffee in Ethiopia, as:

- Private farmer (smallholders of at least 2 ha, including coffee estate).

- Union : Group of Cooperatives gathering farmers with lees than 2ha mainly (garden coffee)

Both have now the ability to get a licence to export directly and provide full traceability of the coffee. - Ethiopian Commodity Exchange (ECX)

The rule of the ECX, a complex trading system

From 2008 until 2017, the Ethiopia Commodity Exchange (ECX) required that all private washing stations, outside of Cooperatives Unions, sell their coffee through the ECX platform. This model was initially implemented to facilitate access to the market for private washing stations and private estates lacking the infrastructure or license to export and to ensure producers a minimum price by avoiding the commissions of multiple intermediaries. It also gave to Ethiopian administration a control and a virtual monopoly on the internal and external market.

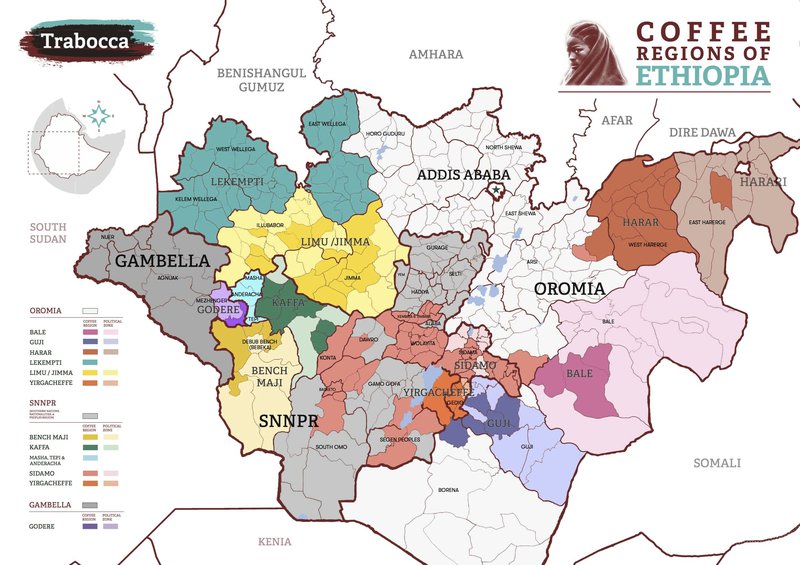

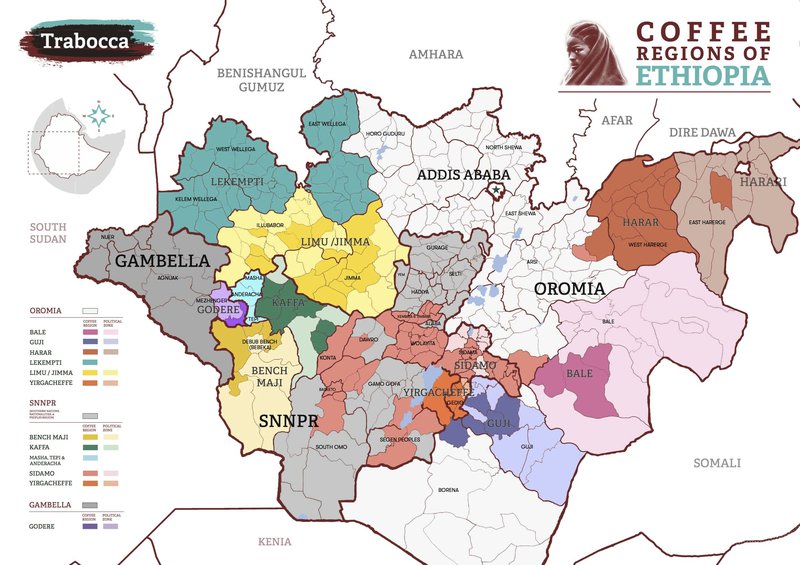

The ECX then classifies the coffee according to a basic potential cup score (Q1 for the highest quality, Q2, Q3 etc...) and location (Jimma, Yirgacheffe, Harrar), and then sell it to licensed exporters through public daily auctions in Addis.

The ECX model has however shown its limits on at least two important aspects :

Traceability

It became difficult to obtain information about a specific cooperative or washing station associated with a lot. Moreover, when bags of coffee, coming from a specific washing station, are unloaded from their truck to operate the control of quality at the regional ECX's collection warehouses, they are unfortunately mixed with coffees from the same region and quality grade. It is therefore impossible to know the exact origin and to have a ECX coffee 100% pure origin.

Purchasers at the auction have to rely merely on the geographical location given by ECX (Kochere, Limu, Lekempti).

Quality

Average quality became sufficient for a given ECX auction grade. And with a low market price, there's no motivation for the farmers to produce better quality.

Moreover it is still impossible for the buyers to taste the coffee before the purchase. They have to rely on ECX's score.

Fortunately, taking into consideration the critics of the private sector and the potential loss of export incomes, the ECX has evolved through a more transparent system relying on new technologies. Thanks to the introduction an electronic auction system, it is now possible to know from which district (woreda) or washing station coffee lots come from. ECX now also provides additional information such as moisture and water activity levels. It might even soon allow purchasers to cup their coffee before the auction.

Moreover, as a result of recent legislation, private producer organizations, including estates, washing stations, and even smallholders of more than 2 ha, can export coffee directly to international buyers without going through the ECX.

COFFEE REGIONS

A BIT OF HISTORY

As everyone knows, Ethiopia is the birthplace of coffee. According to the legend, Kaldi, a 9th-century Ethiopian goat herder, discovered coffee when he noticed that his goats appeared to "dance" after consuming wild coffee beans. Further evidence suggests that the word "coffee" may originate from "Kaffa", the name of an Ethiopian region famous for its forest coffee.

CHALLENGES FOR THE COFFEE INDUSTRY IN ETHIOPIA

Productivity

Despite the huge potential for collective production of coffee in Ethiopia, the average yield per hectare remains very low at 0.72 metric ton per hectare.

And thus for several reasons:

Coffee suffers an increasing competition of khat or chat, a plant with narcotic effects, in different areas of the country, particularly in the Hararge region. Khat is chosen by many farmers because it is more profitable and brings a consistent income during the year.

Low productivity is also the result of a bad management system, poor agronomic practices, trees not well pruned and little access to improved varieties developed by the Jimma Agricultural Research Center.

Initiatives are taken though to improve the productivity as described in a report launched by the Food and Agriculture Organisation:

15 farmers who are trained in modern farming methods are encouraged to demonstrate these methods to their neighbours... With improved practices and better seedling varieties, farmers can now produce ten quintals per hectare, as opposed to six quintals per hectare under the old method.

Complexity of the value chain

The conventional coffee value chain in Ethiopia involves a large number of intermediaries and is still largely state-controlled. Licenses are required for every function in the market chain. As a result, most of the coffee farmers in Ethiopia are not capable of getting the benefits of their production and marketing.

Lack of support to the farmers

No access to credit to cover production costs, processing and marketing investments

Low prices and lack of bargain power

Although more farmers have access to direct trade and potential better prices, there is a necessity for them to acquire new skills, especially if they want to focus on quality: cupping and sensory knowledge, market understanding, necessary knowledge to have a better position and bargain capacity in front of their buyers.

There is also a need for a better redistribution of the price. Make sure, for example, that the premium paid for specialty or certified coffee actually reaches the farmers and is not kept by some middleman taking advantage.

Lack of labour force

There's a decreasing number of aging coffee farmers. Children that have grown with the coffee, seeing the struggles their families face, often choose to migrate to the city to find better opportunities. Or to produce other crops such as khat which requires less care and ensure a regular income due to the rising demand. And with an average price of 2 birr/kilo of coffee cherries (about 8 cents)... it is difficult to convince them to come back to coffee. It ALSO becomes more and more difficult to find coffee pickers for the harvest.

Climate change

Rising temperature and decreasing rainfalls ;

occasional drought, erratic rainfall, leading to crop failure, land degradation, delay of the harvest, exposure to coffee berry disease and diminution of land area favourable for coffee plantation as the arabica can no longer bear the rising temperatures.

Deforestation

Ethiopia has already lost 60 percent of its forest coffee over the last 40 years due to deforestation, a trend expected to accelerate with climate change.

To fight climate change, the country needs to diversify coffee production systems, diversify coffee genetic resources, strengthen coffee research institutions, improve soil and water conservation practices and use water conserving irrigation systems in moisture-stressed areas.

STRENGTHS OF ETHIOPIAN COFFEE

Its wide diversity of profiles due to the variety of climates, soils, average rainfalls, altitudes, topographies and temperatures.

Ethiopia benefits from optimum growing conditions throughout the country, with altitudes ranging from 1,200 to 2,750 m.a.s.l, average rainfall of around 2000mm/ year and temperatures between 15 and 25C. The mountain ranges found in Ethiopia maintain tropical forests whilst there are also sub-tropical areas.

Most of Ethiopia's coffee at present is grown organically without the use of pesticides, although it is difficult for farmers to afford the cost of certifications, especially if they are not supported by their buyers

References:

- Essays, UK. (November 2013). Challenges and Opportunities of the Ethiopian Coffee Sector. Retrieved from https://www.ukessays.com/essays/economics/challenges-opportunities-ethiopian-coffee-6395.php?vref=1

- www.perfectdailygrind.com/2017/05/main-challenges-faced-coffee-producers/

- www.xinhuanet.com/english/2018-04/16/c_137115646.htm

- www.fao.org/docrep/003/x6939e/X6939e12.htm

- www.ifpri.org/blog/ethiopias-coffee-farmers-struggle-realize-benefits-international-markets

- www.sustainableharvest.com/blog/a-new-era-for-ethiopian-coffee

- www.32cup.com/changes-in-ethiopian-coffee-structure/

****

****

Harvest Time | October to January

****

Altitude | 1,200 to 2,750 m.a.s.l.

Colombia

Colombia Ethiopia

Ethiopia Guatemala

Guatemala Indonesia

Indonesia Kenya

Kenya Mexico

Mexico Philippines

Philippines Tanzania

Tanzania Uganda

Uganda