Coffee in Tanzania

Coffee in Tanzania

CONTEXT

Coffee is the second highest valued agriculture export after tobacco in Tanzania.The economy of the country is mainly based on agriculture. And coffee is one of Tanzania’s primary agricultural export commodities. Over the past 30 years, it is accounting for about 5% of total exports value, and generating export earnings averaging USD 100 million per year. More than 90% of the countries output originates from small farmers rather than estates and provides employment to 400,00 families and affect more than 2.4 million citizens directly (10% of the population).But coffee is also among of the long stagnated industries under agricultural sector for last 15 years with average production in the range of 800,000 to 1,000,000 bags annually. Yields have continuously decreased and quality potential has not been fully exploited, thus contributing to low farm gate prices, and the development of rural poverty.Tanzania has a long tradition of coffee growing. It provides abundant land with appropriate altitude, temperature, rainfall and suitable soil for high quality arabica and robusta production.Tanzanian coffee production averages between 30-40,000 metric tons annually of which approximately 70% is Arabica and 30% is Robusta.

VARIETALS

Traditional varieties that are widely used are, Typica, Bourbon (introduced by the missionaries in the Kilimanjaro region in 1890) Blue Mountain and Kent varieties, both mutations of typica. TACRI (Tanzanian Coffee research Institute) has developed hybrid varieties from the old traditional Bourbon trees to be more disease resistant.

GRADING

Tanzania opted for British nomenclature of grading which is done according to shape, size and density. These grades includes; AA, A, B, PB, C, E, F, AF, TT, UG and TEX.

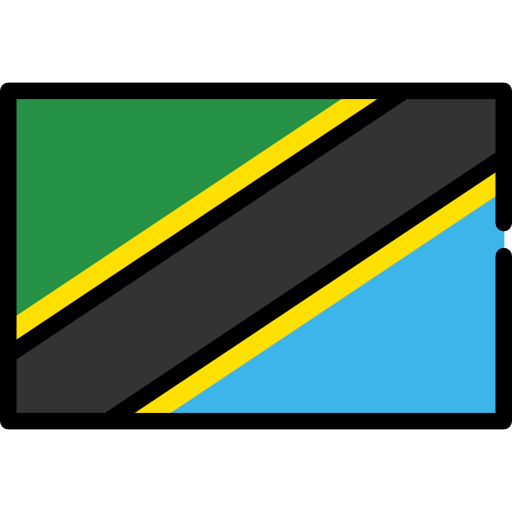

COFFEE REGIONS

Tanzanian arabica coffees are grown on the slopes of Mount Kilimanjaro and Mount Meru in the Northern areas, under the shade of banana trees. It also grows in Southern Highlands of Mbeya and Ruvuma regions where coffee is both intercropped with bananas and some areas are pure stand. Arabica coffee makes up to 70% of total country production. Robusta coffee is grown in the western areas along Lake Victoria in Kagera region. This constitutes 30% of the total coffee production in Tanzania.

A BIT OF HISTORY

Native Robusta…

In the country’s far northwestern coffee lands, the Haya people of what is now the Kagera region, bordering Rwanda and Burundi, cultivated indigenous Robusta.

...Introduced Arabica

Arabica first arrived with the European missionaries from the French-held island of Réunion to Bagamoyo in 1868, after receiving the blessing of Zanzibar’s Sultan.

Commercial coffee then spread near Kilimanjaro in the early 1890s. Arabica was planted in 1902 in Moshi, cultivated by the local Chagga ethnic group and establishing a local economy that eventually organized into an Arabica auction system, still in place in Moshi today.

The British absorbed German Tanganyika after World War I in 1918 and accelerated coffee cultivation. In 1925, the first Tanzanian coffee farmer cooperative was established, and by 1950 there were more than 400 in the country.

Tanzania earned its independence in 1977, nationalizing and redistributing former estates.

In 1977 all coffee cooperative unions were dissolved and the government mandated the Coffee Authority of Tanzania. Until 1982, the Tanzania Coffee Authority bought and sold all coffee in the country but the coffee production suffered drastically due to major governmental interventions and high cost of growing.

Reforms in the early 1990s which privatized the industry drastically increased the efficiency of the system. The Tanzania Coffee Board was reinstated to issue permits and licenses and coffee growing and selling was made entirely independent. Moreover, they are responsible for grading beans and running the Moshi Coffee Auction

TRADING SYSTEM

There are three ways a farmer can sell his product

- Internal market – where farmers sale at farm gate price to private coffee buyers, farmer groups and cooperative. Coffee is sold in form of cherry or parchment.

- Auction – Coffee auctions are conducted every week on Thursdays during the season (usually 9 months). Licenced exporters come to the auction and buy coffee from suppliers who can be individual farmer, groups, and cooperative or from private buyers.

- Direct export – Growers of premium top grade coffees are allowed to bypass the auction and sale their coffee directly. Direct export enables growers to establish long term relationship with roasters and international traders. Most top grade coffee growers are thus allowed to bypass the auction and are able to sell their coffee directly to the foreign roasters. This policy was created by the Coffee Board of Tanzania to allow farmers and local companies to build a long term relationship with international buyers

Observations

On January 14, 2018, Tanzania’s Prime Minister Kassim Majaliwa dissolved the Tanzania Coffee Development Trust Fund, claiming it was redundant and depriving farmers of their money.

At the same time, he directed the revocation of all licenses for traders purchasing coffee directly from farmers, reinstated cooperatives, and mandated all coffee be purchased by exporters through the auction, effectively eliminating the possibility of direct trade from farmer to exporter.

As doubts remain about the concrete application of this egulation, coffee farmers and traders might face a complex new scenario. Farmers will not only be deprived from the possibility to sell their coffee through direct trade. They will also need to comply specific requirements and conditions to be allowed to sell their coffee to public auction. For example, farmers will need to be organized under groups of minimum 50 members, while usually, smaller organizations were able through direct trade to improve their production (both in volume and quality), find new market, sell their coffee at a better price and were thus able to improve equipment, infrastructures, and working conditions.

Under this regulation, trader, exporter or roaster will no longer be allowed to buy coffee directly to farmers:

“Coffee will be sold through auctions only.

No licences should be provided to traders to buy coffee in the villages. If there are companies that have people in the villages with cash for that purpose, they should recall them as soon as possible...” said Prime Minister Majaliwa .

The perspective of losing the direct trade alternative brings concern and uncertainty.

CHALLENGES FOR COFFEE PRODUCTION IN TANZANIA

Diagnosis

Tanzania’s coffee crop has struggled in recent years, however. Productivity has been down and farmer access to credit hard to come by. The TCB, working on a strategic coffee development plan lasting from 2011 to 2021 to double production, missed its 2017 target by 41 percent

Tanzania Coffee boards has identified the main causes of the continuous decreasing yields for this problem is the age of the coffee trees (particularly in the Kilimanjaro regions) as well as deficient husbandry practices. It is usually considered that a coffee tree becomes economically unprofitable when it passes the age of 20-25 years (over 40 years in the Northeastern regions). In Tanzania, most of the 240 million coffee trees around the country have exceeded this age.

This is generally exacerbated by:

- Poor farm maintenance practices such as insufficient pruning and stumping of trees,

- Poor management of pests and diseases

- Improper intercropping with banana and other crops, causing soil depletion and overshadowing due to lack of support on agronomic issues.

- Lack of agricultural inputs (fertilizers, pesticides, fungicides),

- Infrastructure: some areas are quite isolated and transport is difficult (road, railway)

How to increase coffee production from the present average of 50,000 tons to at least 80,000 tons and reach 100,000 tons by year 2021?

It is envisaged that the increase in production volumes will go hand in hand with increase in quality from the present 35% premium coffee to at least 70%.of the total production.

How to ensure a better and sustainable outputs?

Proposed Solutions

The Tanzania Coffee Board propose a wide-spread replanting of coffee farms with improved varieties could help to address this issue by reducing the quantity of inputs needed while providing increased incomes to coffee farmers thus improved financial capacity to procure these products.

Colombia

Colombia Ethiopia

Ethiopia Guatemala

Guatemala Indonesia

Indonesia Kenya

Kenya Mexico

Mexico Philippines

Philippines Uganda

Uganda